Indigenous Reconciliation

Regulatory

Construction Opportunities

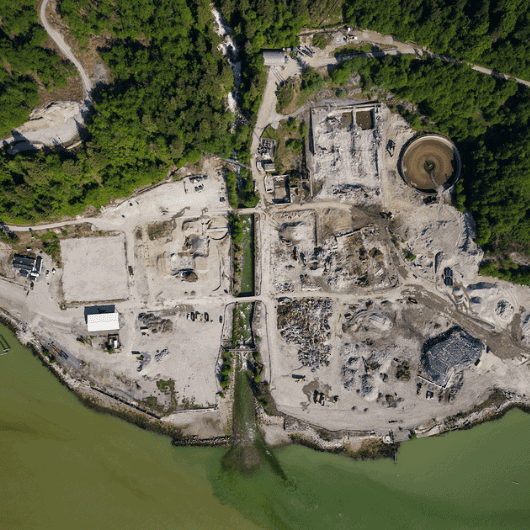

Construction

Safely Building the World’s First Net Zero LNG Facility

The Woodfibre LNG Project will be the world’s first net zero LNG export facility and will set a new global standard for sustainability in the industry. Woodfibre LNG is committed to building the facility in a way that protects human health and safety, including the safety of Indigenous peoples, women and girls – both in the community and on our construction site.

BUILD

YOUR

FUTURE

Woodfibre LNG is committed to ensuring that local individuals and businesses benefit from our Project, both during construction and in future operations.

Woodfibre LNG Careers

At peak construction we’ll have approximately 850 people working on site, and about 100 long-term operations roles.

Business Opportunities

Sign up to ensure that your business meets procurement requirements for Project opportunities. The Directory will be shared with contractors involved in Project-related activities on a regular basis.

Net Zero

Low Emission by Intentional Design

Powered by renewable hydroelectricity, Woodfibre LNG is designed to be the lowest carbon intensive LNG export facility in the world. Woodfibre LNG prioritizes electric drive compressors and other technologies to reduce and avoid emissions.

LNG exported from the facility will be used in Asia as an alternative to emission-intensive, coal-fired electricity.